How to Manage Your Finances With Microsoft Excel

This blog post is your ultimate guide to how to manage your finances with Microsoft Excel.

So, if you’re intimidated by the idea of using Microsoft Excel to manage your finances, you’re in the right place.

You will learn how to use Microsoft Excel to manage and save money.

Overview

Managing personal finances is a daunting prospect for most people. But having the right tools can help make it less challenging.

While most people use Excel to track their budgets, manually updating your budget spreadsheet every month is a time-consuming process.

But with the right knowledge of Excel, you can make the process a more seamless experience.

So, today, you’ll learn about how to use Excel to manage your finances to simplify your day-to-day money decisions. With this guide, you can stay on track with your longer-term financial goals.

Why You Need To Budget for Your Expenses

Budgeting is a great way to keep track of your spending, income, and savings. This will ensure that you are on track with your finances and can meet future goals.

For example, I am saving to purchase my first home. Each day, the money I save makes a huge difference. Knowing where my income is coming from and where it's going gives me greater control over my financial decisions.

If you have more than one account for your income and expenses, it's important to track them separately. No matter how much detail you are expecting about your income or spending habits, having an Excel budget will help maintain control over your finances.

Use Microsoft Excel for your financial spreadsheets to access them anywhere with Office 365.

Your spending habits are logged so you can decide where to cut costs. Each month is different because there's more income coming in than out, but it's necessary to track in order to make better decisions.

How To Use Excel for Budgeting

Before you can begin creating your ultimate budgeting spreadsheet, you need to get access to Excel. If you don't own the application yet, check out our store and purchase Microsoft Excel. Alternatively, you can install Microsoft Excel from the Office 365 app store.

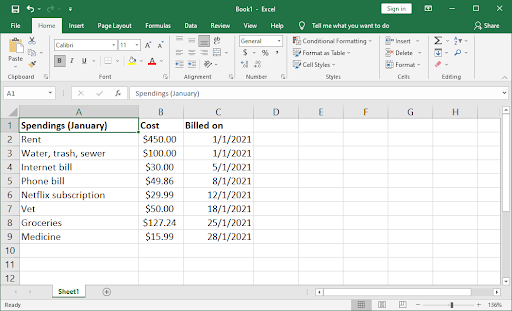

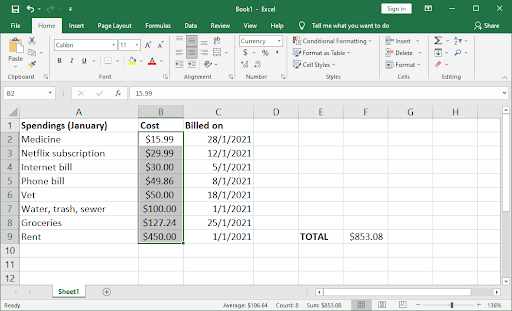

Step 1. Set Up the Budgeting Spreadsheet

Setting up your workbook for finances is easy. First, list all of your bills on one side. Try adding as many monthly expenses as possible. You should also include the amount of money spent, and the date of the expense. It seems easy enough; just start with what I have done below:

Of course, you can expand this further by adding more details, such as the payment method, notes, and more. This is your spreadsheet, get creative and customize it for your needs!

If you want to keep things super simple, you can stop here. This is already a great budgeting sheet that lets you keep track of things with ease. However, you can take it several steps forward by implementing functions.

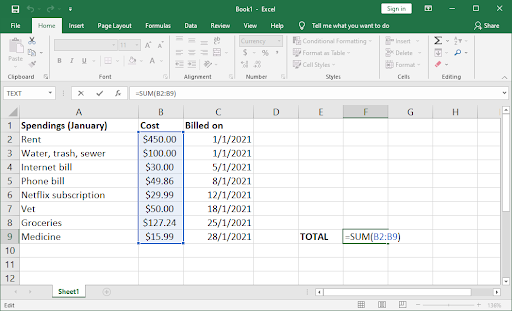

Step 2. Add Excel Functions to the Sheet

If you know how to use SUM, then it is easy to implement a cell for your total spendings, income, or savings.

The first step is to create a formula that will pull up the total amount of your bill from your list of bills on the left side. You can do this by using the SUM function, which is one of the basic features of Excel.

Here’s how to get the total working:

- Decide on which cell you want to hold your total, and select it.

- Type in the following formula: =SUM(B2:B9). If you’re not following along with our sheet, make sure to replace the cells with the first and last cell in your spreadsheet.

- Press Enter. You should see the total of your money immediately displayed. This total will automatically and accurately calculate a new total as you spend more or gain more income during the month.

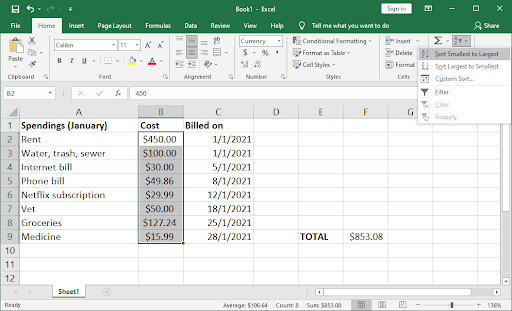

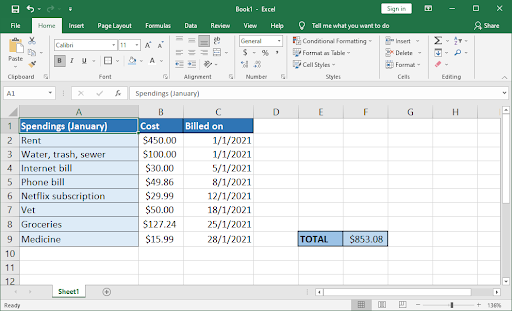

Step 3. Get Better Insight by Sorting Your Data

You can easily see which of your expenses are the highest, by simply sorting the spreadsheet. For example, maybe your cable television bill is higher than it really should be.

From there, you can get a sense of what you might need to do — whether that’s negotiating a better price on your package, or cutting the cord entirely.

- Highlight your cells that hold currency data. When done, switch to the Home tab in your ribbon, and click on Sort & Filter, and then select either Sort Smallest to Largest or Sort Largest to Smallest.

- A warning may appear on your screen. Here, we recommend selecting the “Expand the selection” option to ensure everything moves properly in your sheet.

- Voila! Your expenses are now organized. This is one of the first steps in learning how to make better financial decisions in the long run.

Step 4. Format Your Spreadsheet for Readability

I recommend adding some visual indicators to your budget workbook to make it easier to read and understand at a glance. For example, if a number is lower than zero (meaning you spent more on it than you had budgeted), add red borders around the cell where that number appears.

You can also create layouts by differentiating between your headers and entries. There’s no right or wrong way to do this, so I’ll show my personal shading as an example below:

You can replicate this look by utilizing the Font Color, Fill Color, and Borders in the ribbon's Home tab.

Additionally, you can change fonts and format text through the same tab as well.

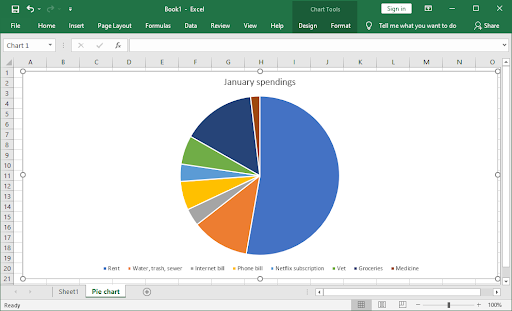

Step 5. Visualize With a Pie Chart

It's hard to notice details when you're just looking at raw numbers, and that fear holds people back from actually taking action on their budgets - which is why Excel has graphs!

They make it so much easier for you to see trends over time with a visual representation and they show where your money goes too.

I have always been intimidated by spreadsheets full of rows upon rows or columns. Thanks to the charts found within Microsoft Excel, anything can be more easily understood as well as broken down into manageable pieces.

The charts and graphs in the program help you see exactly where all of your money is going, making it a lot easier for me to save up some dough!

At first, seeing that I spent $30 USD on various online subscriptions in a month doesn’t seem that alarming at first glance. After seeing how this amount looks in proportion to what

I spent on my groceries, I knew that it’s time to review what services I’m subscribed to. This simple pie chart saved me almost $20 USD every month.

The 5 Best Finance Tracking Templates for Excel

Many people prefer to work with templates as they save an immense amount of time. But finding the right template for your needs can be a real nightmare. Here are 5 of the best finance tracking templates for Excel:

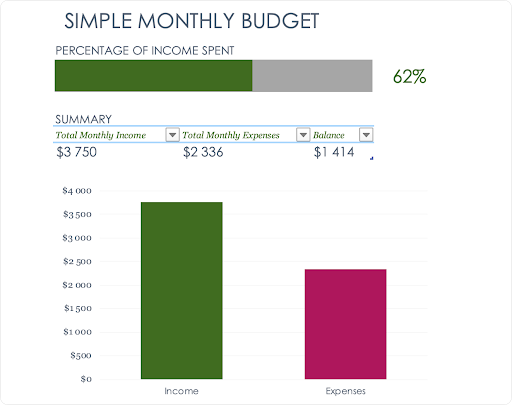

1. Simple Monthly Budget Template by Microsoft

If you have never worked with an Excel spreadsheet before, then you will find this budget template incredibly easy to use. This workbook will help you see the cash flow in your life. Complete these three pages and then compare them to understand where all of your money is going!

The main page shows a snapshot of how much money came into, went out from and remained on hand at any given time over the course of one month. The next two pages are Monthly Income and Expenses.

You can update the pages according to what's coming in or being spent throughout this year.

Download the Simple monthly budget template here. (Free)

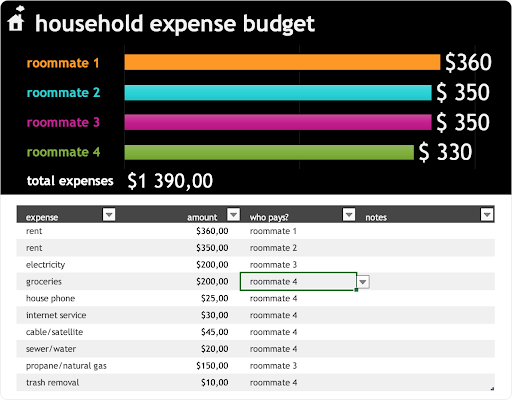

2. Household Expense Budget Template by Microsoft

Do you share payment responsibilities with other people and find it difficult to keep track of who has paid what? Introduce the budgeting template into your lives so that all roommates are involved in this process.

The customizable spreadsheet shows how payments will be spread amongst everyone, which is great for adjusting responsibility as needed.

Do you know how it's difficult to keep track of your expenses when you have an irregular income? For example, if one person pays the hydro bill while another pays for groceries. Well, this is where a roommate payment template comes in!

The free customizable spreadsheet helps make sure everyone knows who paid what and there are no more disputes over who should pay next time because everything is clear on paper (and easy to access or update online).

Download the Household expense budget template here. (Free)

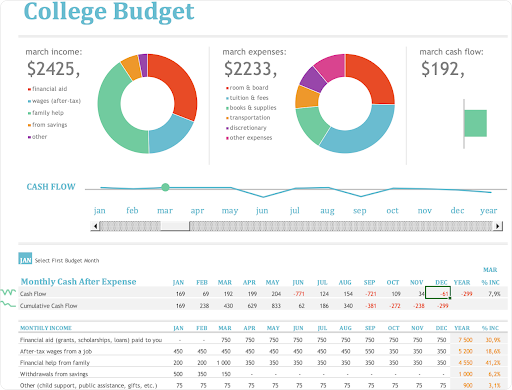

3. Monthly College Budget Template by Microsoft

College is a lot of responsibility, and financial decisions can feel daunting. Thankfully this template has all the tools you need to make smarter financial choices!

The customizable graphs will allow you to visualize your spending habits at any time, while also giving an overview of how much money remains in your account each month.

Create multiple tabs for different types or goals so that it's easier for yourself when managing finances with schoolwork on top of everything else going on during college.

It'll be like having a personal assistant always right there, guiding you every step of the way.

Download the Monthly college budget template here. (Free)

4. Tax Expense Journal Template by Microsoft

This template is the perfect way to simplify your taxes. With a sophisticated design and tracking features, you'll be able to keep an eye on every expense that needs attention for tax purposes.

The sleek table design automatically updates as you make changes — just like other templates in this list! You can also add more rows with ease, or attach useful notes, dates, descriptions, and totals at any time of year.

At the bottom of each page, there's always a “Total” amount displayed so it's easy enough to make smart decisions about where your money goes before filing!

Download the Tax expense journal template here. (Free)

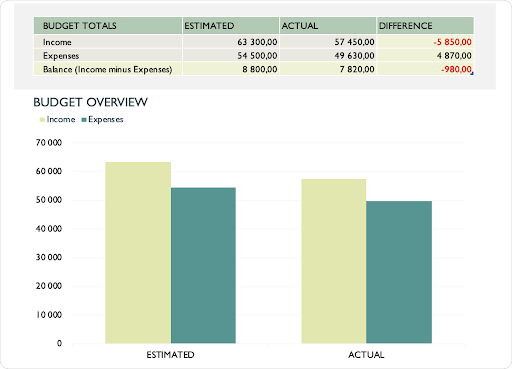

5. Monthly Company Budget Template by Microsoft

Keeping track of expenses and income is necessary for individuals, but it's also crucial to a business. This template lets you log in all the money that comes into your company as well as everything going out.

It has features that help with budgeting and forecasting — such as an easy-to-read bar graph on the first page, which breaks down how much was spent over a time period.

You'll be able to see how much has come in vs what was predicted, as well as seeing all expenses broken out into subcategories like personnel or operating costs. This way, no detail gets missed.

While logging information can often feel tedious, this intuitive template is designed specifically to keep things easy-going without compromising quality.

Download the Monthly company budget template here. (Free)

Final Thoughts

That’s it: You now know how to manage your finances with Microsoft Excel.

If you were having difficulties in managing your budget before, just follow this guide to track your spending.

Now, it’s your turn.

If you’d like to know more about Excel, visit our Help Center for more Excel topics.

Also, sign up for our newsletter below to get our updates on new guides, promotions, deals, and discounts.

You May Also Like

» Expense Record & Tracking Sheet Templates for Excel

» How to Calculate CAGR in Excel

» Save Hundreds of Dollars With These Google Chrome Extensions